TAX PREP SERVICES

TAX SOLUTIONS

Securely exchange documents with me for quick and easy two-way communication using the client portal. Capture signatures in the cloud on your Apple or Android mobile device. Book an appointment with me or click get started below and sign up for an invitation to MyTaxPortal. Pay tax return fee with a refund transfer taking pressure off out-of-pocket costs. I offer solutions such as pre-paid cards, check printing and direct deposit for speedy delivery to you and stay insured with errors and omissions insurance.

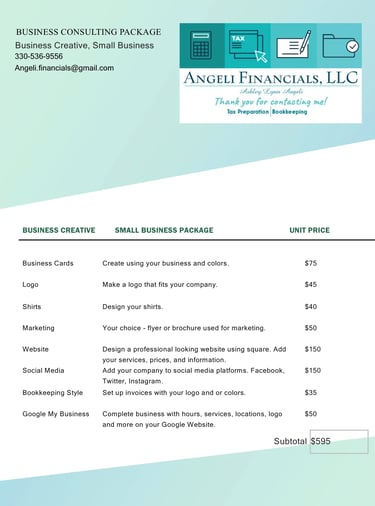

BUSINESS CONSULTATIONS

BUSINESS CREATIVE PACKAGE

I help create your business, making

dreams of owning your own work a reality with ease! Book a consultation appointment to get started.

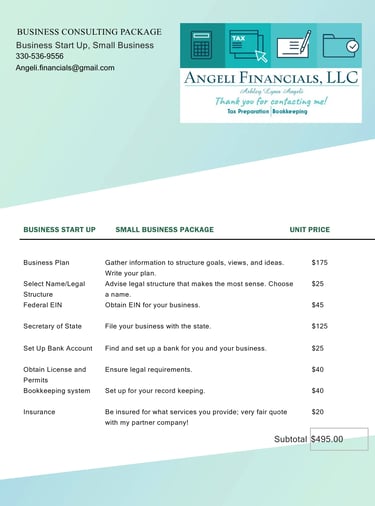

BUSINESS START UP PACKAGE

One of our most popular packages! Exceptional quality and choice. This is the basics you need to start working legally. Book a consultation appointment to get started.

BOOKKEEPING

BEST BOOKKEEPING PRACTICES

Keep your personal and business finances separate. Make sure you and your employees do not buy personal things with business funds. You may suffer legal consequences so be sure to open up separate credit card and bank accounts for your business.

Determine which accounting method you will use. There are two standard methods, cash basis or accrual. Cash method is when accounting records transactions at the time cash actually changes hands and is usually only recommended for businesses that strictly deal with cash payments. The accrual method uses the matching principle to record revenues and expenses in the period they occur, regardless as to when payments are made or received. The accrual method I feel is more complicated to work with but is the best when invoicing clients. One acceptable method is the modified cash basis and its between cash and the accrual method. You are on a cash basis except you record bills in accounts payable and send invoices in accounts receivable.

Use accounting software to track business expenses such as receipts on a daily, weekly or monthly period. If you don't have a simple way to track this information, it can take up much of your time. Software can be costly as well. I recommend Wave Accounting, the software is free and easy to navigate!

Track employee time. You could use an app like Homebase. This can be downloaded on your phone. Invite employees to upload the application on their phone for ease to log their time using the app.

Evaluate your financial data monthly for understanding.

Plan for taxes throughout the year. Staying organized can reduce your tax burden and help avoid costly penalties.

Keep all your records for at least 7 years. This will help you stay compliant in case of an audit.